Value Creation

and Value Sharing.

Investment policy

Alto Partners focuses upon attractive, growing business sectors where our team has acquired a particular expertise. These investments can serve as ideal platforms for developing premier niche leaders into valuable assets for strategic trade buyers or acquisitive sector consolidators over a three-to-five-year period.

Main sectors of interest

Design, luxury

and clothing

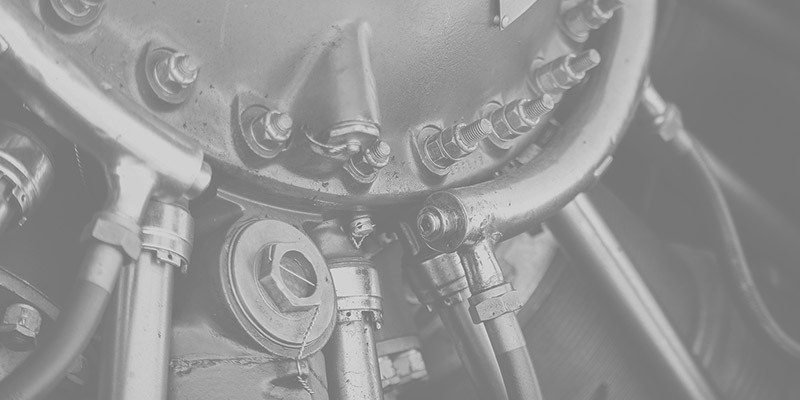

Precision mechanics and electromechanics

Food

Services and specialised distribution

Chemicals and pharmaceuticals

Geographic focus

Italy, particularly Lombardy, Piedmont, Veneto, Emilia Romagna and Tuscany

Deal types

Buyout/majority to support generational transition. Expansion/minority to support development programs

Exclusions

Start-up, turnaround and restructuring; real estate and financial services; non-ethical sectors

Process

Alto Partners is a majority or controlling minority shareholder, focusing upon business development through intensive portfolio company monitoring. It actively drives growth initiatives and industrial acceleration in its portfolio companies by leveraging its solid industrial background, broad network of contacts, and sector expertise.

- Diversified client base

- Demonstrated cycle resilience

- Control of distribution channels

- Strong brand recognition

- Geographical market diversification

- Export-oriented businesses with strong international exposure

- Differentiated manufacturing process

- Innovation capacity

- Revenue growth

- Solid profitability

- Low indebtedness

- Strong cash generation

- Capacity to execute build-up strategy

Each investment is completed after an extensive due diligence process aimed at thoroughly understanding strategic, tax, accounting, legal, insurance and ESG aspects

Each investment is subject to continuous, proactive monitoring. Alto Partners actively cooperates with each portfolio company and its management to support the growth plan

Company support

Company support is provided by Alto Partners’ leveraging on its exclusive network of industry experts, primarily via such assistance as:

Top-line growth

Evaluation, selection and negotiation of strategic acquisitions

Selection and recruitment of qualified human resources

Implementation of corporate governance best practices

Managing interaction with banks

Brand development and positioning

Introduction to new potential customers or suppliers

Promoting relationships between portfolio companies and sector entrepreneurs

Our achievements

A long-term partnership with companies and entrepreneurs resulting in*:

REVENUES

Growth of aggregate portfolio companies revenues (556 million to 726 million Euro)

EBITDA

Aggregate portfolio companies EBITDA growth (82 to 112 million Euro)

EMPLOYEES

Net increase in aggregate employees (2,005 to 3,067 FTEs)

*Figures include all the investments and exits part of the Team’s track record